2021 Rental Waiver Framework(CBRE) 15 September 2021

On 13th September 2021, the Ministry of Law unveiled the Rental Waiver Framework (RWF) under the COVID-19 (Temporary Measures) (Amendment No 4) Bill. The RWF is expected to commence in October 2021.

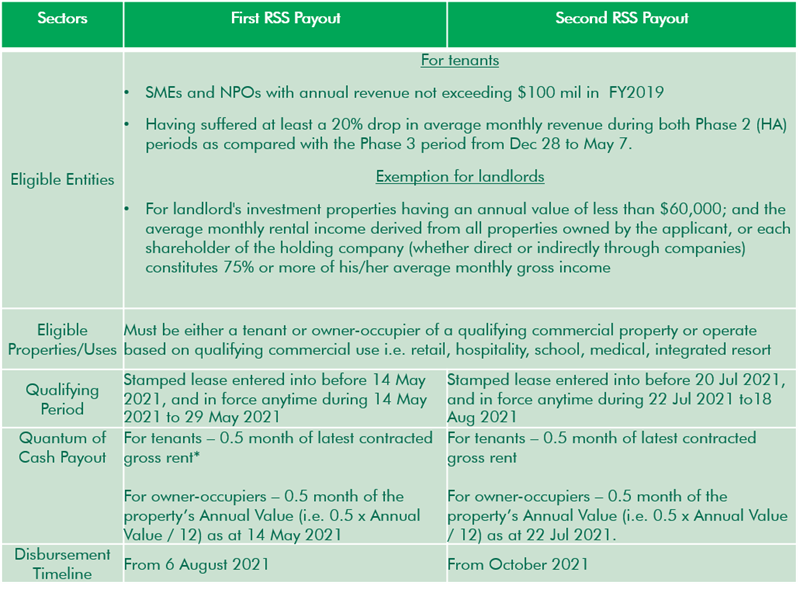

During the Phase 2 (Heightened Alert) (P2HA) periods between (1) 16 May to 13 June 2021, and (2) 22 July to 18 August 2021, some businesses were disrupted by the safe management measures imposed to curb the spread of the COVID-19 virus. Under the Rental Support Scheme (RSS) announced in May 2021, the government introduced support measures to alleviate the economic impact on both small and medium enterprises (SMEs), as well as eligible non-profit organisations (NPOs). The support measures included two cash payouts - the first pay-out was to be disbursed starting from 6 August 2021, while the second payout will be disbursed in October 2021.

Table 1: Rental Support Scheme Payout

*Note: Gross contracted rent will include gross turnover rent, maintenance fees and service charges. In-kind assistance such as additional advertising or parking promotions cannot be offset.

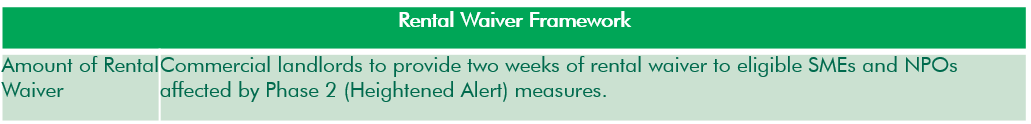

In addition to the two payouts under the RSS, the RWF stipulates commercial landlords to provide two weeks of rental waiver to eligible SMEs and NPOs affected by the P2HA measures. This aims to ensure the fair co-sharing of rental obligations over the P2HA periods between the government, landlords and eligible tenants.

Table 2: Rental Waiver Framework (RWF)

Together with the one month of rental support in cash, coupled with the two weeks of rental waiver, qualifying tenants in privately owned commercial properties will receive about 1.5 months of rental support in total. This compares to about two full months across the two P2HA periods.

Landlords who have provided rental support to their tenants during P2HA may offset from their rental waiver obligations any direct monetary assistance or rental waivers provided from May 16 up to the date they receive all the tenant's supporting documents.

CBRE Research Views

The mandatory rental waiver under the RWF is intended to establish a baseline position for the handling of tenants’ rental obligations. Ultimately, it is important for both landlords and tenants to work out mutually agreeable arrangements based on their specific circumstances, as challenges tied to COVID-19 are not a one-off but a long-term process.

The rental payouts and waivers this year can be considered to be more equitable and encompassing. Compared to the Rental Relief Framework in 2020, the latest RWF sets a directive for landlords to waive the 0.5 months of rental definitively. In addition, the payouts and waiver took into account gross turnover rent, maintenance fees and service charges, on top of the base rents.

Overall, the framework helps to ease the cashflow pressure for SMEs and NPOs, in particular those in the retail sector, which have been hit hardest during the pandemic.

For further information, please refer to the links below:

Rental Waiver Framework 2021 (mlaw.gov.sg)

Rental Waiver Framework for Businesses Impacted by Phase 2 (Heightened Alert) (mlaw.gov.sg)

IRAS | Government Cash Payout (2021 Rental Support Scheme)

This article was originally published in https://www.cbre.com/