The performance of Sydney and Japan hotels are expected to be driven by increasing domestic travel on the rollout of vaccinations, while international visitors won’t arrive in masses anytime soon.

In addition, Asia’s cruise industry has been recovering quickly as operators nimbly tap into pent-up travel demand, which could grow further with mass vaccinations in Asia and globally.

In the past quarter, hotel deals remained at historically low levels, as owners hold rather than sell assets at a discount, given support from banks and governments.

To view full report please visit Real Capital Analytics please visit : https://www.rcanalytics.com/rca-insights/

Read More

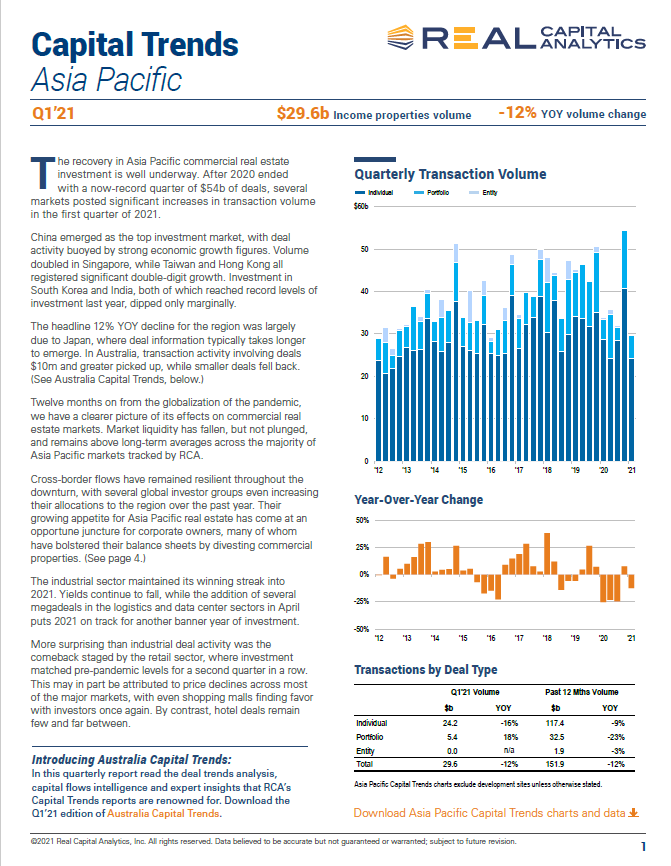

A GOOD START TO A YEAR OF EXPECTED ECONOMIC RECOVERY