More than three years after the onset of COVID-19, Singapore retail sales have recovered and exceeded pre-pandemic levels. However, foot traffic and retail rents have yet to fully recover. CBRE’s proprietary study finds that consumers are now visiting malls less frequently but for longer durations. Consumption patterns have also changed, driven by the proliferation of e-commerce, rising income levels and increased focus on wellness and ESG.

This report identifies the main trends shaping Singapore’s retail property market in the post-pandemic era and provides recommendations for retail occupiers and landlords to navigate the structural shifts and cyclical recovery of Singapore’s retail market. Government initiatives, the return of tourist spending and a wider selection of locations are also providing opportunities to all stakeholders.

This report was originally published in https://www.cbre.com.sg/insights/viewpoints/singapore-retail-in-the-post-pandemic-era-trends-and-opportunities

Download the Report Read MoreKey findings:

The real estate market has experienced a significant change due to the global inflation and rise in interest rates in the last two years. Moreover, the sector has been undergoing a transformation driven by technological innovations, which has changed the outlook and expectations of the market participants. In response to the persistent inflationary pressures, the regulators in the APAC region have adopted various measures to protect the stability and integrity of the real estate market in Q2 of FY24.

One of the common themes across the region is the implementation of stricter anti-money laundering rules, which aim to increase the transparency and accountability of the transactions. For example, Australia, India, Singapore and Japan have all introduced new or enhanced regulations to combat money laundering in the real estate sector.

Another trend that is shaping the real estate market in the APAC region is the growing emphasis on environmental sustainability and social responsibility. Many developers and builders are adopting net zero targets and improving their ESG credentials by incorporating green technologies and practices into their projects. This not only reduces the environmental impact of their operations, but also creates value for their customers and stakeholders by enhancing energy efficiency and reducing energy costs. Therefore, by aligning their strategies with tech-enabled initiatives, they are creating a more resilient and competitive market.

These developments indicate that the APAC region is preparing for a new era of opportunities and challenges for investors and developers in the housing and commercial real estate sectors. The regulatory updates in Australia, India, Japan, China, Singapore and Hong Kong provide a framework and guidance for navigating the changing market conditions and expectations. They also reflect the diversity and dynamism of the region, which offers a range of prospects and potentials for diverse types of real estate investments.

In this edition of APREA Real Assets Bulletin, we have covered the regulatory updates pertaining to green transformation in real estate, tech-led strategies and initiatives adopted to streamline the real-estate transactions, and risk-mitigation measures undertaken by APAC economies through anti-money laundering measures for safeguarding the real estate sector.

Download the Report Read MoreThe electric vehicle (EV) market in Asia Pacific has grown significantly over the past two years, with the region accounting for nearly two-thirds of global EV sales in 2022.

As EV adoption continues to gather pace, demand for public charging infrastructure in Asia is also rapidly increasing, primarily due to the prevalence of apartments where the installation of private chargers is subject to regulatory restrictions and administrative barriers.

The growing number of EVs in Asia Pacific will require a significant increase in charging facilities. CBRE estimates the number of public charging points across the region will rise from around 2 million in 2022 to around 10 million by 2030.

All of these converging trends present a significant opportunity for real estate owners and investors to gain access to or expand their presence in the EV public charging infrastructure market.

This report was originally published in https://www.cbre.com/insights/reports/how-will-electric-vehicles-impact-real-estate-in-asia-pacific

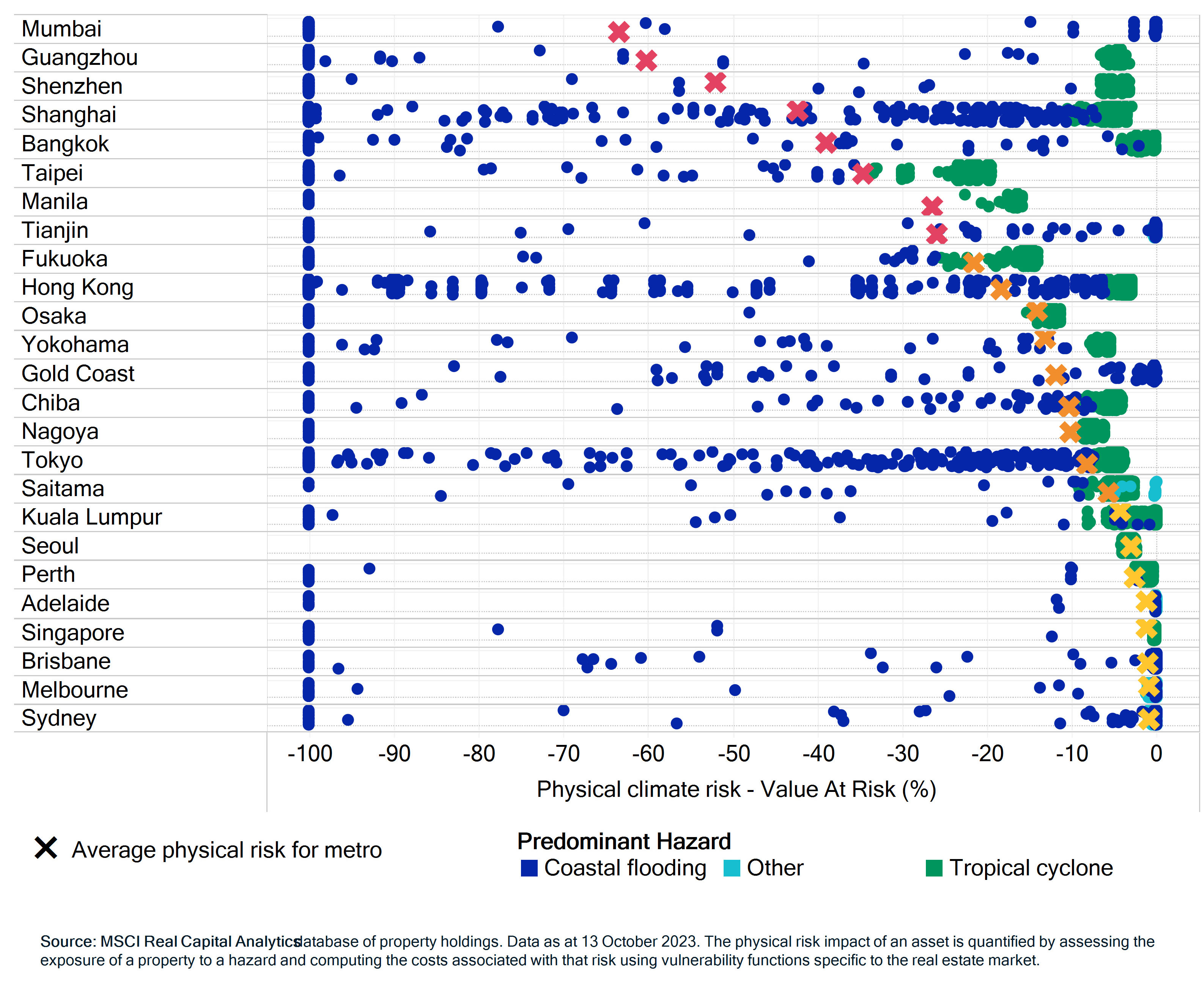

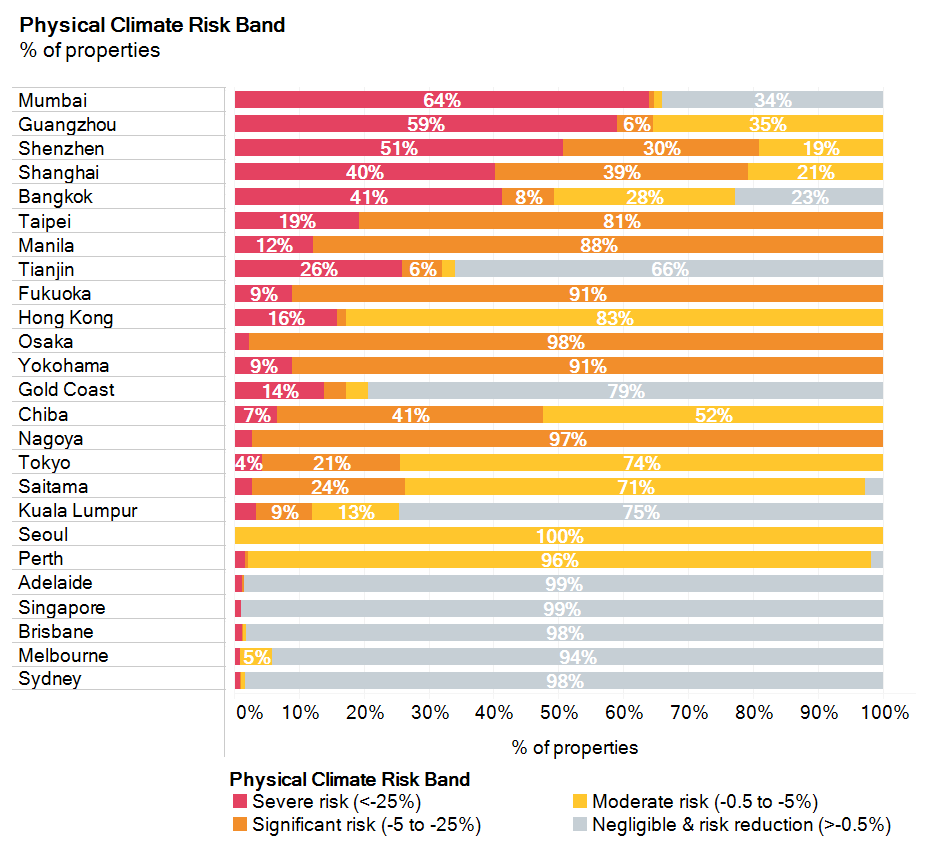

Download the Report Read MoreApplying climate analysis to MSCI’s Real Capital Analytics database of global property holdings, we can see a broad range of aggregated physical climate risks across real estate in selected Asia-Pacific cities. As we previously showed for cities worldwide, these risks were not equally distributed within each city.

Once again, location and topography were decisive factors behind the impact of physical climate change, reinforcing the idea that investors may wish to consider climate risk at the individual asset level, rather than relying solely on market-level data.

The charts below illustrate Average physical risk vs. risk distribution across major Asia-Pacific metros

Average for metro and asset-level

% of properties

Vice President

MSCI Research