CBRE Asia Pacific Research and the U.S. Green Building Council have jointly launched the Asia Pacific Real Estate Chief Sustainability Officer Survey, which provides insights from landlords and investors across the region on how they are addressing the ESG imperative, the role of the CSO in achieving their goals, and their companies’ level of preparedness in achieving net zero, as well as any obstacles that are hindering progress.Key findings include:

This report was originally published in https://www.cbre.com/insights/reports/asia-pacific-real-estate-chief-sustainability-officer-survey

Download Now Read MoreThe Asia Pacific real estate landscape is evolving, witnessing a surge in alternative sectors such as data centers and healthcare. A collaborative survey by APREA and CenterSquare Investment Management gathered insights from diverse industry leaders and professionals, revealing a notable inclination towards alternative real estate.

Investors foresee higher potential returns in these sectors over the next 1-3 years, with a strong focus on data centers, healthcare, and multi-family and student accommodations. Challenges include limited stock availability and the importance of operating platforms for optimal returns.

Japan is perceived as the current hotspot, while Indonesia and Thailand emerge as promising markets for the future. The survey emphasizes the need for ongoing education to enhance investor understanding of the evolving real estate dynamics.

Download the Report Read MoreIn 2024, Southeast Asia's real estate landscape, influenced by robust economic fundamentals and changing demographics, spotlights growth opportunities in the Philippines, Malaysia and Vietnam. The industrial and logistics sectors, driven by rising e-commerce demand, lead investor interest, with a surge in the wellness and healthcare space.

In the Philippines, industrial real estate gains favor, the luxury residential segment sees a surge, and the office sector anticipates improvement. Malaysia projects a robust 2024, emphasizing industrial, logistics, and data centers, with ESG considerations gaining importance. Vietnam, overcoming economic challenges, shows promise in the industrial sector and expects a tenant-led office market.

Investors eye these markets cautiously, considering interest rate differentials and managing currency fluctuations for favorable risk-adjusted returns in Southeast Asia's thriving real estate markets.

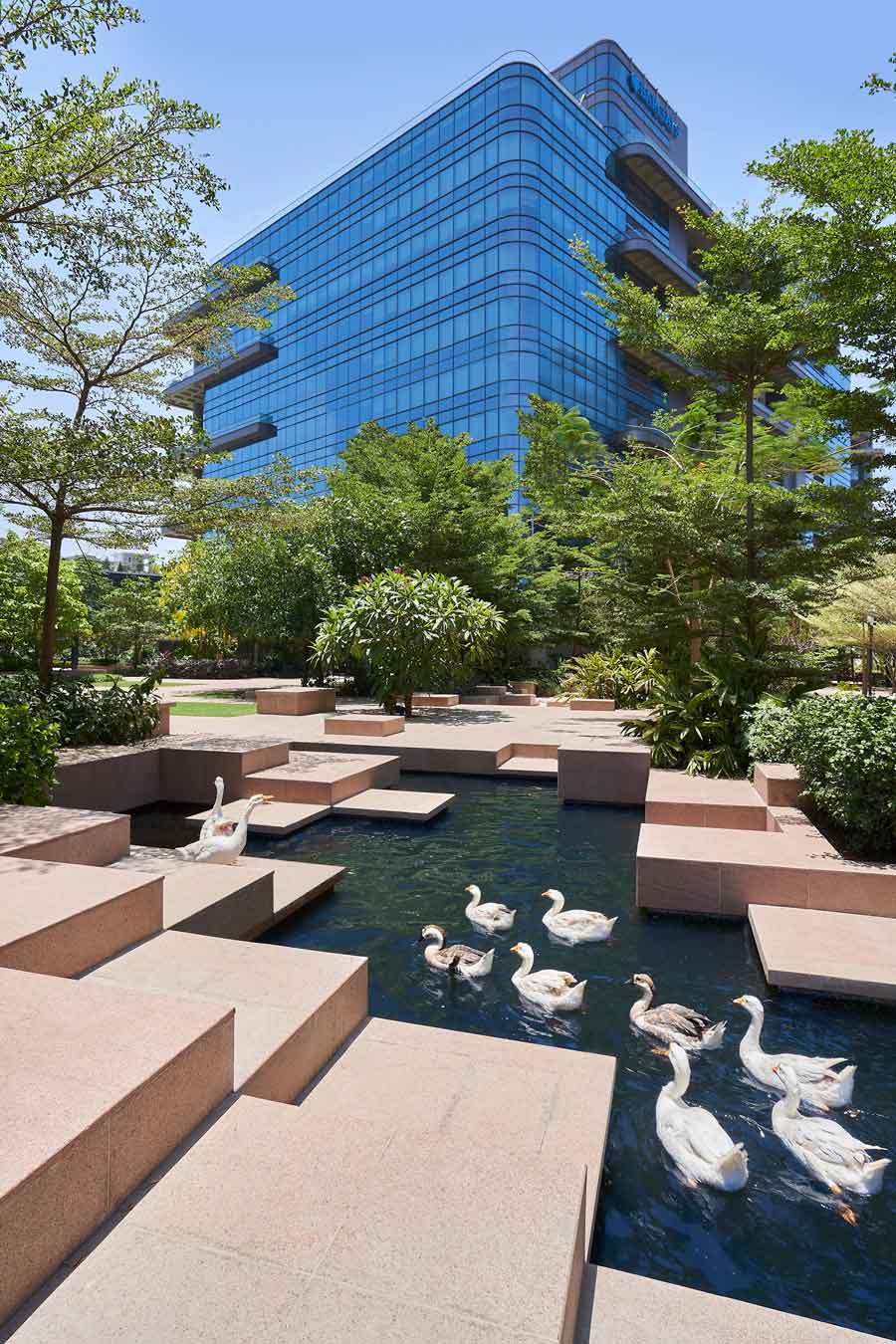

In today's dynamic business landscape, where environmental concerns are at the forefront of global discussions, the Indian real estate sector has embraced a transformative shift towards sustainability. One of the pioneering Indian sectors – real estate is revolutionizing the industry through Grade A ecosystems of green office spaces while contributing to a thriving economy. India is currently ranked third in the world with more than 752 LEED-certified properties after China in Canada, basis USGBC Annual list.

A holistic, sustainability-driven, Grade A ecosystem is fostering business growth across India, through several initiatives:

Setting Industry Standards for Green Office Ecosystems

The real estate industry’s shift towards sustainability is marked by a growing preference for green office spaces that seamlessly blend eco-consciousness with industry-relevant standards. These spaces are designed with a deep consideration for energy efficiency, resource conservation, and reduced carbon footprint. By incorporating advanced technologies and innovative architectural designs, green office spaces not only promote a healthier environment but also set a new benchmark for industry standards, inspiring others to follow suit in creating sustainable workspaces.

Sustainable Practices at the Core

Getting these green standards in place requires collaboration. Real estate professionals, architects, environmental experts, and regulators need to join forces. They will need to establish clear metrics for energy usage, water management, indoor air quality, and all-around sustainability. Certifications offered by esteemed organizations like LEED & IGBC add weight, serving as a seal of approval for genuine green credentials. As the demand for sustainable workplaces surges, these green office space standards are pivotal. Those who construct and use these spaces are shaping a cleaner and greener future.

Preferred Choice for Organizations and Employees

Grade A green office spaces' success transcends mere adherence to environmental benchmarks; they have evolved into the favoured choice for both organizations and employees. In today's professional landscape, there is profound esteem for spaces that harmonize with sustainability-oriented principles. Consequently, employee preferences for eco-conscious work environments influence organizational decisions significantly. Abundant greenery, natural illumination, and fresh air collectively exert a positive influence on the overall work milieu, fostering heightened creativity, engagement, and job satisfaction.

Fostering Business Growth

These practices have not only resulted in positive environmental impact but also spurred humungous business growth and aided economic growth. The adoption of sustainable practices has led to the creation of jobs in various sectors, ranging from renewable energy installation to eco-friendly construction materials.

The influx of businesses into these spaces has led to increased foot traffic in areas within these ecosystems, benefiting local businesses such as cafes, restaurants, and retail stores around. The growth of these businesses, in turn, generates employment opportunities and contributes to the overall economic vitality of the region.

In conclusion

On the path to sustainability, the Grade A ecosystems within green office spaces adeptly strike a harmonious equilibrium between modern infrastructure and ecological accountability. However, the influence of these spaces extends beyond environmental preservation. Responsible businesses prioritize eco-friendly and healthy workspaces that align with their values, ensuring sustainable growth in demand for these thoughtfully designed environments.

MD & CEO - Commercial Real Estate

K Raheja Corp

The real estate market in the Asia Pacific (APAC) region has shown remarkable resilience and adaptability despite the rapidly changing global landscape. Geopolitical advancements in APAC economies have led to a transformation of the real estate sector, with technology and sustainability integration gaining traction. These changes have also impacted the development of fast-paced projects.

As the real estate industry around the world catches up with technology-led innovations, there is a shift towards environmentally friendly building practices due to rising carbon emissions. This shift is evident in the updated real estate regulations in the APAC region for 3QFY24. Many APAC countries, such as China, Singapore, Australia and Japan have introduced green infrastructure and technology-integrating guidelines to address this challenge.

Further, countries like Australia and Japan have shifted their focus from specialised asset classes, such as data centres and cold storage, to Build-to-Rent asset types. While demand from occupiers has weakened due to tighter liquidity, investors have shown a keen interest in commercial and industrial real estate. Moreover, a new theme of inclusivity and equal housing rights has emerged in economies such as Hong Kong and Japan, which is expected to impact other APAC countries in the coming years.

Despite the ongoing challenges, APAC economies present an attractive opportunity for investors due to regulatory updates across various classes and asset types. These economies are expected to play a crucial role in channelling regional investments and development.

Download the Report Read More