The ongoing recovery in key property markets across Asia Pacific continued in the second quarter of 2021 and looks set to sustain through the second half, aided by strong demand for commercial assets from end-users as well as investors.

In China, a total of 30 deals were finalised across major markets, as both domestic and foreign market participants sought to acquire key assets across property segments. Korea continued to witness record-high unit prices for prime office space in Seoul, and Japan’s property markets remained buoyant in the face of stringent restrictions. In Singapore, investment activity was dominated by the privatisation of REITs, while in India, global private equity (PE) firms and developers made significant acquisitions in metro markets. Taiwan witnessed a surge in demand for commercial property from manufacturers on the back of strong export growth. In the Philippines, e-commerce companies and outsourcing firms took up space in data centres while healthcare and logistics companies should lead office take-up in the coming months. Thailand’s office market remained stable though its troubled hospitality industry could see higher transaction levels as beleaguered owners look to sell assets. We also expect to see more joint ventures between Thai and international investors across sectors. In Indonesia, the residential sector is expected to receive a boost from the extension of a tax waiver while urban mixed-use projects in the capital, Jakarta, received an influx of foreign funds as investors bet on a speedy post-COVID-19 recovery.

Download the Report Read MoreOne of the four core APREA services together create synergy for sustainable growth of members across the region:

Advocacy through:

Read on for the full updates from our 2021 Q2 Advocacy Bulletin Updates which includes the following items:

• NDRC has made a new announcement for China Infrastructure REITs on 2 July

• India’s SEBI reduces the trading lot size for REIT and InvITs to enhance liquidity

• Greater Sydney Construction Activity Pause

• Grant scheme for OFCs and REITs in Hong Kong

• SGX launches world's first ESG Reit derivatives

• Singapore Land Betterment Charge Act 2021

• Implications of the G-7 Global Minimum Corporate Tax for Singapore

• Extension to Temporary Relief Measures for Property Sector due to Coronavirus Disease 2019 (COVID-19) Pandemic

• Refinements to Criteria for Publicly Listed Housing Developers with Substantial Connection to Singapore to be Exempted from Qualifying Certificate Regime

尽管新冠疫情前景尚未完全明朗,其对亚太地区写字楼租户的干扰正在减少。在灵活办公和新型工作模式日益普遍的趋势引导下,区域内企业已经在重启对不动产策略的长期规划。

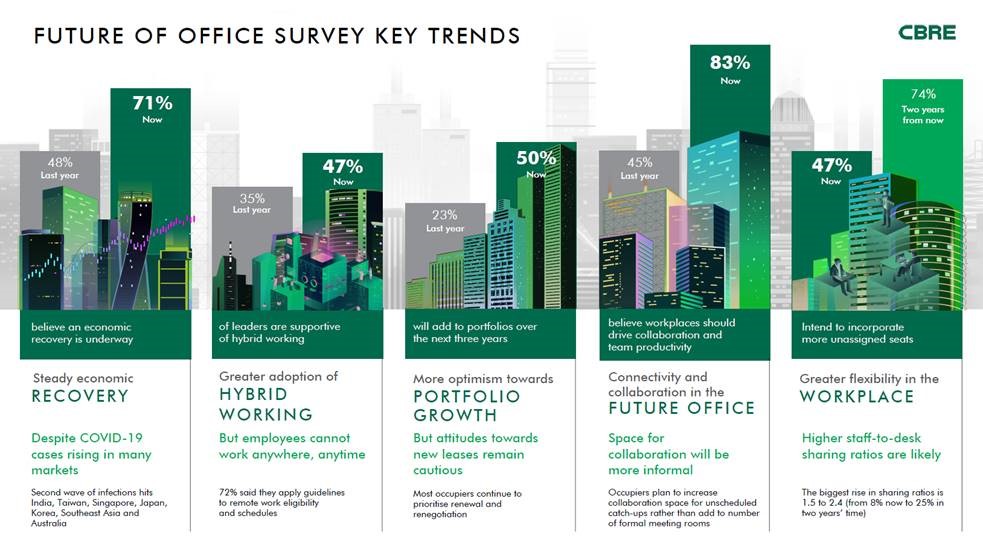

针对“新常态”之下的写字楼发展和企业租户的应对措施,CBRE世邦魏理仕于5月启动了《未来的办公场所——2021年亚太区写字楼租户调查》,并于近期发布调查结果,确立了“区域内经济稳步复苏”、“企业不动产组合规模增长预期提高”、“混合办公趋势上升”、“未来的工作场所将更重视促进沟通与协作”、“企业将实施更具灵活性的工作场所设置”等五个主要的写字楼趋势。

该项针对亚太区各地不同行业写字楼租户的调查发现,大部分(71%)受访企业都认为企业经营环境正持续改善,这一比例显著高于2020年4月(22%)与10月(48%)的两次调查结果。其中,大中华区和太平洋地区受访企业的市场信心水平最高,而印度和东南亚地区企业对市场的乐观程度则相对较低。

Download the Report Read MoreOverview

Stock markets dived in mid-June when the US Fed indicated possible quantitative tightening and a potential interest rate hike by 2023, as investors remained jittery of rising inflationary pressures and its implications on monetary policies. The region’s equity market also fell on concerns amid the strengthening greenback. Further weakness was also evident as the resurgence of outbreaks, which had governments reviving restrictions across several economies, threatened to derail recovery momentum in the region. However, property stocks across the region largely bucked the trend, underpinned by accommodative monetary conditions and sustained interest in dividend-rich stocks amid a yield-starved environment.

Listed Real Estate

Despite outperforming the region’s equities, June was another tepid month for non-REIT real estate stocks in the region with the wider GPR/APREA Listed Real Estate Composite barely staying in positive territory. In a repeat of May, gains in Australia, Hong Kong and Japan just managed to offset caution in the other regional heavyweights of China and Singapore. China’s real estate stocks underperformed for a third month running as policy overhang continued to plague sentiment, with policymakers moving to restrict credit growth and stepped up interventions in markets.

Hong Kong’s shares continued to maintain its positive run, driven by a notable pickup in property sales and prices as well as optimism surrounding it e-voucher scheme, which is designed to boost local consumption. Blackstone’s HK$23.7 billion bid for HKSE-listed Soho China also signaled sustained investor interest. Stocks in India also gained as the country’s central bank continued to maintain interest rates at record lows.

REITs

The GPR/APREA Composite REIT Index finished strongly in June, outperforming regional equities both in June and for the second quarter. While renewed infection surges could have spurred interest in safe-haven Industrial REITs, the gains were broad based with even the risk-on sectors registering gains. A weakened Japanese yen during the period also spurred investments into J-REITs. Separately, the prospects of an eventual re-opening of its economy and borders supported the performance of Hong Kong REITs.

China’s first batch of REITs made a rousing stock market debut registering initial gains, as the nine listed REITs – five in Shanghai and four in Shenzhen – drew interest from Chinese retail investors. The nine REITs reportedly raised over RMB30 billion with its retail tranches 10-times over subscribed. For now, C-REITs are backed only by infrastructure assets and offered as units in a fund. But the trial will be closely watched – the success of which could eventually seed measures for further liberalization.

Meanwhile, the Philippine REIT pipeline remains on track. Hot on the heels of Filinvest’s planned third quarter debut of its REIT, the country’s largest office landlord – Megaworld – is looking to unveil the nation’s largest offering that is seeking to raise as much as PHP27.3 billion. Data centre giant, Digital Realty Trust, is also considering an offering in Singapore that could raise up to US$400 million which could come as early as this year. The share sale would tap growing investor interest in data centres. The region’s expanding REIT universe is continuing apace with up to 10 new listings that could occur in the second half of the year.

Outlook

While inflationary pressures will continue to introduce volatility, monetary conditions are expected to remain loose as central banks remain cognizant that an economic recovery remains far from certain. Investors are also choosing to remain focused on the longer term. Countries in the region are now training their sights on increasing vaccination rates, raising the prospects of an accelerated re-opening of its economies. Institutional interests in the region’s commercial real estate have continued to be robust, as investors, awakened by prospects of more favourable entry prices especially in gateway markets, chase deals. The region’s REITs, in the first six months of the year, have returned close to 9.0% to overtake equities, indicating a gradual reversion to long-run fundamentals.

Download the Report Read MoreWith many markets succeeding in containing the pandemic and relaxing restrictions on business and social activity to some degree over the past six months, this year has seen a significant improvement in business sentiment across Asia Pacific. About 71% of survey respondents believe current business conditions are improving, marking substantial progress from the two surveys CBRE conducted in October and April 2020. Confidence was highest in Greater China and the Pacific, while India and Southeast Asia were less optimistic as they struggle to contain a new wave of infections. The unpredictability of infection rates will continue to weigh on the pace of the regional recovery for the foreseeable future. However, the rapid increase in vaccination rates in mature Asia markets and the reopening of offices globally will further strengthen corporate confidence in the handling of the pandemic.